About Platron

The Platron company has been successfully operating in the Internet acquiring market since 2009. During this time, more than five thousand Internet companies became our clients, more than 100 million transactions were processed with a conversion rate of 99.8% and guaranteed service availability of 99.9% (Uptime SLA).

Accepting payments for your business

Platron has many years of experience in implementing payment services for various business sectors. The main approach of our company is an individual approach to each client and building long-term mutually beneficial relationships.

Clients of the online payment acceptance service Platron are provided with a set of the most popular payment methods under one agreement and within one technical integration.

Platron operates on its own software and does not depend on vendors or service providers. Acquiring services and settlement services under an offer agreement are provided by credit institutions — partners of our service, which allows our company to provide its clients with services at flexible competitive rates and diversify the risks of operating activities.

A convenient personal account allows our clients to receive analytical and aggregated reports on completed transactions, and our own fraud monitoring system makes it possible to operate with individual settings while maintaining a high conversion rate.

The use of an electronic document management system allows you to completely eliminate paper document flow at all stages of interaction, and a flexible approach to all formal procedures saves the client time. We also offer clients integration with all major online cash register service providers within the framework of Federal Law No. 54-FZ.

Conditions

The Platron company offers flexible tariffs for its clients; the final commission amount is determined by a combination of main factors:

- type of activity of the service provider for transactions with a bank card (seller category code, Merchant Category Code)

- planned/actual turnover

- payment method (SBP, bank card, electronic wallet)

- jurisdiction of incorporation of the supplier’s legal entity

- payer jurisdiction (Russian or foreign card)

Basic price offer model depending on the client’s monthly turnover:

- up to 1 million rub — from 3,1%

- from 1 million rub up to 5 million rub — from 2,3%

- over 5 million — the rate is agreed upon individually

International internet acquiring

The Platron company implements projects both with companies of the Russian Federation and with non-resident companies. Payments are made according to a schedule convenient for the client in the currency agreed upon by the parties.

As part of a unified integration, Platron clients have access to servicing bank cards issued by foreign banks. The Platron system supports more than forty authorization currencies.

Credit organizations – partners

Payment methods

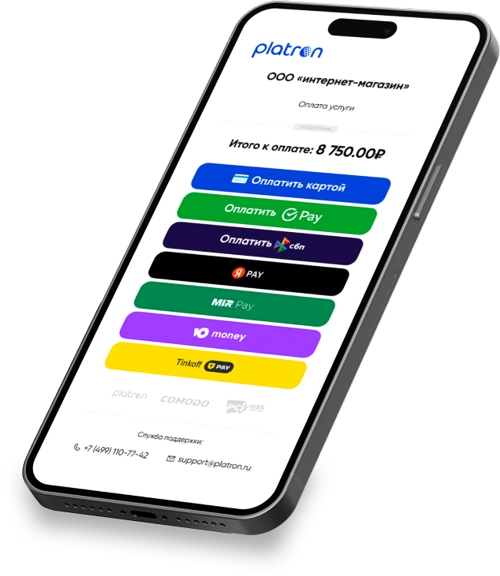

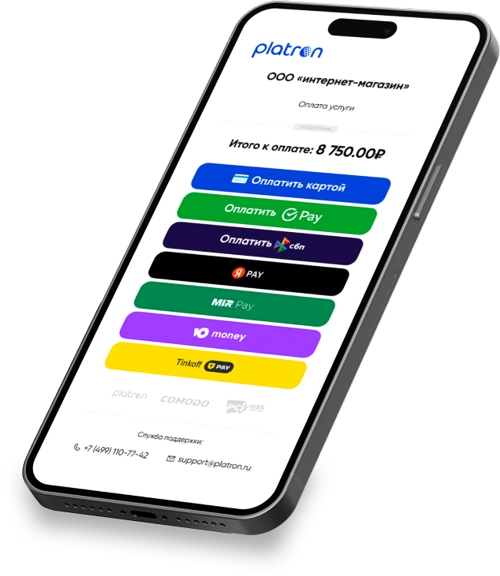

The Platron company provides a set of the most popular payment methods that fully satisfy the needs of any client. When submitting an application, the client must indicate the payment methods that need to be connected.

All selected payment methods will be available to the client in our payment form:

- A bank card is the most popular online payment method, despite the active development of alternative payment technologies. The Platron system allows payment by cards of payment systems PS Mir, Mastercard Inc., Visa, China UnionPay

- The Fast Payment System (FPS) is an increasingly popular and most in-demand payment method that allows you to pay for purchases, including using a QR code, and receive payments from organizations. The SBP was developed by the Bank of Russia and JSC National Payment Card System. The Bank of Russia is the operator and settlement center of the system, and NSPK is the operational and payment clearing center. this is a fast and secure payment directly from the account in favor of the seller. The buyer pays for goods and services using a QR code without entering bank card data. Using this payment method, the client is offered a more favorable service rate compared to bank cards.

- Yandex Pay is a service that allows millions of people to make online purchases, order delivery and pay in installments in one click. For users, this is a convenient payment method, and for businesses, it is an opportunity to increase profits. The user selects Yandex Pay and the card he wants to pay with, the service automatically fills in the payment information, and the payer receives additional cashback.

- MIR Pay is a mobile application from the Mir payment system for payments with a smartphone. To make payments on your phone, unique payment keys are reserved in encrypted form. When paying online, you do not need to enter your card details – just click on the «MIR Pay» button on the payment page and confirm the operation in the application.

- YooMoney is an electronic payment system with which you can make purchases over the Internet.

- Sber Pay a service from Sberbank for paying for online purchases in a couple of clicks.

- Tinkoff Pay — service from Tinkoff Bank for paying for online purchases in a couple of clicks.

Connection

To connect to the Platron payment service you will need three simple steps:

- Fill out a connection application

- Fill out the form and sign the application to join the offer agreement

- Carry out technical connection:

Technical connection

Platron company offers clients several options for implementing technical interaction:

- API integration

- Connection via CMS module

- Providing a payment link to the client

We use a single API to accept payments within the country and abroad.

When connecting, we always take into account the specifics of your business and make the necessary settings.

Multi-acquiring

We provide clients with the opportunity to connect several acquiring banks, which ensures the highest level of uninterrupted operation. The client has the opportunity to independently select the acquiring bank in the settings of his personal account.

Payment functionality

- Recurring payments

- Holding (blocking) funds on the payer’s card in case of recalculation of the cost of the order or refusal of the order

- Automatic refunds for all types of payments, including the possibility of partial refunds

- Payment acceptance page in a familiar design for clients, as well as convenient and fast implementation in an iframe

- Our own fraud monitoring system (anti-fraud): we will select combinations of settings to minimize the possibility of fraudulent transactions while maintaining a high conversion rate

Payments to cards

Platron offers a service for mass payments in rubles and foreign currency — for individuals in the Russian Federation and abroad to bank cards and electronic wallets.

Payments are made through high-performance and reliable payment gateways of our partner banks. Connection to the service is carried out through the API of our information system Platron.Pro

Legal information

The Platron company operates as a bank payment agent — a payment aggregator and as an operator of information exchange services.

When concluding contractual relations with clients within the framework of the Offer Agreement, Platron acts on behalf of settlement credit institutions in the status of a payment aggregator on the basis of Federal Law No. 161-FZ «On the National Payment System», which, in accordance with Federal Law No. 115-FZ «On Anti-money laundering and countering the financing of terrorism» creates an obligation for Platron to identify clients, their representatives, beneficiaries and beneficial owners according to its own internal control rules.

When the client concludes a direct agreement with the acquiring bank, the Platron company performs the function of information and technological interaction between settlement participants in the status of an operator of information exchange services on the basis of an agreement with the bank. In this case, client identification is carried out directly according to the internal control rules of the credit institution.

Documentation

Download file for accepting ESP RNKO Unified Cashier through the Platron system

Download file Information about the activities of the payment aggregator

Download file Agreement offer for the use of the Platron system

Download file For individuals – payers and users of services, the Rules for using Platron services apply

Download file Platron company processes personal data of subjects in accordance with the Privacy Policy of Platron LLC

Information Security

Platron’s activities comply with the information security requirements of payment aggregators and information exchange service operators.

Download file The Payment Card Industry Data Security Standard (PCI DSS) is a comprehensive security standard that includes requirements for security management, policies, procedures, network architecture, software design, and other critical security controls. Platron PCI DSS Compliance Certificate

Download file Summary of the report on assessing the compliance of the Platron company with the National Standard of the Russian Federation GOST R 57580.1-2017 «Security of financial (banking) transactions. Protection of information of financial organizations. Basic composition of organizational and technical measures»

Download file Summary of the report on the results of comprehensive testing of the Platron software product in accordance with the requirements for the assessment level of confidence 4 of the national standard of the Russian Federation «GOST R ISO/IEC 15408-3-2013. Methods and means of ensuring security. Criteria for assessing the security of information technologies»